Find the balance of the common stock account in the stockholders equity section of the balance sheet. Common stock can be found in the stockholders equity section.

How To Read A Balance Sheet Complete Overview

Incorrect inventory balance being reported in the balance sheet at the year-end may cause wrong figures to have appeared when it comes to reporting the values of assets and owners equity on the balance sheet of the year.

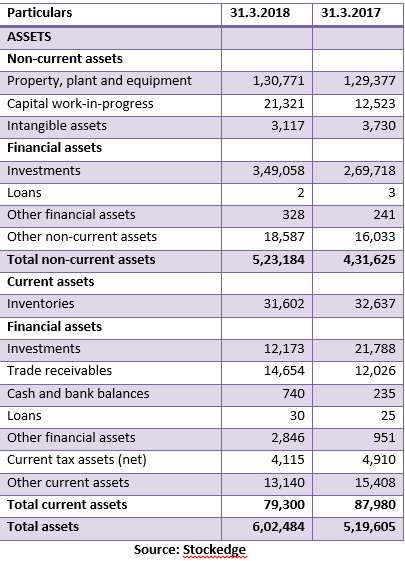

How to find stok in balance sheet. In the Balance Sheet report double click quick zoom the Inventory Asset amount to open the Transaction by Account detail report. This is the percentage of the companys debt measured against its assets. Determine the companys typical payout ratio.

Ill leave a link to stockcard in the video description below to check that out. Its important to know how to find preferred stock when looking at a balance sheet because it represents the dividends that will go to stockholders first and may be used for financing. The weighted average inventory method can be used to achieve a balance sheet estimate of inventory stock.

Ill be starting in the Featured Collections area of Stockcardio a great resource for finding groups of stocks around a theme and well start with the Strong Balance Sheet collection of stocks a list of 79 companies with solid financial positions then narrow our list from there. The journal entry to record the exercise of the option involves debiting. A video tutorial designed to teach investors everything they need to know about common stock on the balance sheetVisit our free website at httpwwwPerfec.

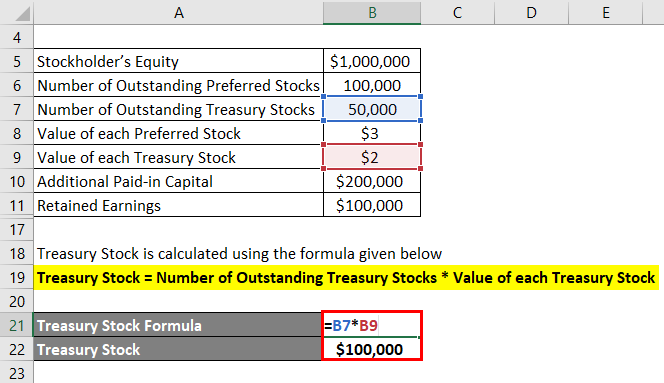

The formula for this is Total Liabilities Total Assets. The Securities and Exchange Commission SEC and its EDGAR website give you all sorts of balance sheet information in a companys 10-K and 10-Q reports. The dollar amount of treasury stock shown on the balance sheet refers to the cost of the shares a firm has issued and then taken back at a later time either through a share repurchase program or other means.

From the balance sheet of the company you can find the total number of shares issued by that company. Similarly it is askedHow does the balance sheet. When you are looking over a balance sheet you will run across an entry under the shareholders equity section called treasury stock.

In this mannerHow to calculate stock prices from a balance sheet. Furthermore these types of errors do not affect the overall balance sheet during the accounting period. This means that the COGS and on-hand inventory is treated comparatively the same when it comes to determining value.

But if we look at a companys balance sheet we find that more often than not this statement is true. Value of the common stock on the balance sheet refers to the par value of the share which is different from the market price of the share. Thats because companies often have to issue stock in order to.

In order to find the amount of common stock in circulation you can look for the common stock on balance sheet publications. Calculate the firms stock price book value from the balance sheet. Divide the firms total common stockholders equity by the average number of common shares outstanding.

Debt creates an expense for a company and can drag down profitability if mismanaged. The equation would be 6300000 100000 63. In the Total By drop-down choose Item Detail.

Additionally how do you account for preferred dividends. Figure out the net income of the company. Some might suggest otherwise.

Calculate the firms stock price book value from the balance sheet. The balance sheet is comprised of equity and liability. For example if the firms total common stockholders equity is 63 million and the average number of common shares outstanding is 100000 then the stock prices book value for the firm would be 63.

Divide the firms total common stockholders equity by the average number of common shares outstanding. It values a companys inventory stock by applying the average cost of on-hand inventory to each item of stock. Multiply the payout ratio by the net income per share to get the dividend per share.

For example if the firms total common stockholders equity is 63 million and the average number of common shares outstanding is 100000 then the stock prices book value for the firm would. The main formula behind a balance. Although the account is called common stock its balance makes up only a small portion of the companys total common stock.

Close the Balance Sheet report. When common stock is sold or repurchased it is usually for a price above the par value so the excess amount over par is credited to an additional paid in capital account. Once youve gathered your assets and liabilities calculate the retained earnings.

If you get a. Window menu Tile Vertically Compare the two reports. Tip In order to locate the value of common stock shares you can use the.

How the Balance Sheet Works The balance sheet is divided into two parts that based on the following equation must equal each other or balance each other out. The first step in calculating sums should be to spend time determining the total. The 10-K is a toned-down once-a-year.

Preferred stock is listed on a companys balance sheet in the stockholders equity section under capital stock. Open both Transaction Detail and Inventory Valuation reports. Long term debt over time A simple way to understand how much debt a company is taking on is to look at the line for Long Term Debt and see how it changes over time.

Determine the number of shares outstanding. The Balance sheet effects. For example if the firms total common stockholders equity is 63 million and the average number of common shares outstanding is 100000 then the stock prices book value for the firm would be 63.

Common stock is valued at par a designated dollar amount used to value each share of common stock on the balance sheet. Per Accounting Tools the remaining amount would be the shareholders equity divided across the number of outstanding shares the shares currently owned by investors and employees not currently bought back by the business. You can use the values you find in the balance sheet to look at its financial ratios.

This balance is the total par value of the common shares the company has issued since its inception. When exploring balance sheet information in Stock Rover here are a few things to look at. This is because it is being.

Divide net income by the number of shares outstanding. Rapidly increasing debt is not. These formulas assess your businesss performance and can be used for comparison with other similar companies in the same industry.

Common stocks are listed in the equity section because stocks are considered as an asset. From the total number of stocks we can calculate the number of outstanding stocks. Thus if you need to determine the price per share of stock you can look at a balance sheet and calculate it yourself.

How to Find the Sum of Common Stock on a Balance Sheet Determining Assets and Liabilities.

Balance Sheet Analyzing Owners Equity

Common Stock Formula Calculator Examples With Excel Template

Setting Closing Stock Manually In The Balance Sheet